Welcome to CU Station™

Leading Credit Union Services for Members

Looking for the most up-to date resource with Credit Union Services for members? CU Station™ strives to support communities and their financial well-being by enabling the connection between potential members and credit unions.

No- Cost For Registered Credit Union Members

With zero-cost to registered users, CU Station™ starts with collecting the necessary information to determine eligibility.

Get Access to Our Word Class Credit Union Services

Once we have identified matches to the available Credit Unions, our registered users can search for available services & products.

We will Help Find the best Credit Union Service for you

Rest assured, we are here to provide general health score information to determine which Credit Union service or product is best for you.

We Are Committed To

We are committed to providing you with clear, accurate, and accessible public information. Our goal is to ensure you can confidently make informed financial decisions, supported by reliable and transparent guidance.

We streamline the process by matching your demographic and personal interests to what credit unions offer. From memberships to loans and services, we identify eligibility and recommend the best solutions for your needs.

We extract publicly available data from credit unions using AI and direct application feeds, ensuring all products, rates, and terms are current. Our impartial approach connects you to the best credit union options.

All our services are free for registered users. We handle data mining and complex matching to connect you with the right loan or membership. Our impartial analysis ranks credit unions, and you pay nothing—ever!

We match you with eligible credit unions, rank their products and services based on your preferences, and provide health score insights. Once you’ve made a selection, we help connect you to your chosen credit union.

We support our community by partnering with mortgage brokers, real estate agents, credit unions, financial influencers, and non-profit charities to promote the credit union system’s member-driven values, ensuring accessible and equitable financial services.

Credit Unions

Credit Unions are community friendly financial institutions that are federally governed. Credit Unions are not-for-profit organizations which means they are required to give back to their members. Credit Unions offer a variety of products and services to their members or shareholders. Due to the federal requirements, Credit Unions have specific requirements for individuals to become members.

CU Station™ simplifies the process and mystery of eligibility by working with Credit Unions to ensure our registered users are matched to the Credit Unions available to them.

"Benefits of working with Credit Unions includes"

Credit unions are community-driven financial institutions that prioritize the well-being of their members. As not-for-profit organizations, they reinvest in their communities and offer personalized services that foster long-term relationships and financial stability.

When you join a credit union, you’re a member, not just a customer. Because credit unions are not-for-profit, they share their profits with members in the form of dividends. These are like small bonuses, usually paid out annually, based on how much money you have in the credit union.

Credit unions offer a more personal approach to banking. Unlike big banks, they focus on building relationships with their members, understanding your unique needs, and providing tailored services that help you grow financially. They’re here to support you, not just make a profit.

Credit unions offer a wide range of loans to fit your needs, whether it’s for buying a car, paying for college, or refinancing your home. With lower rates and flexible terms, credit unions make it easier to get the financial support you need, when you need it.

Credit unions offer a full range of financial products and services, from savings accounts and credit cards to insurance and retirement planning. They’re committed to helping you manage all aspects of your financial life with products designed to fit your needs.

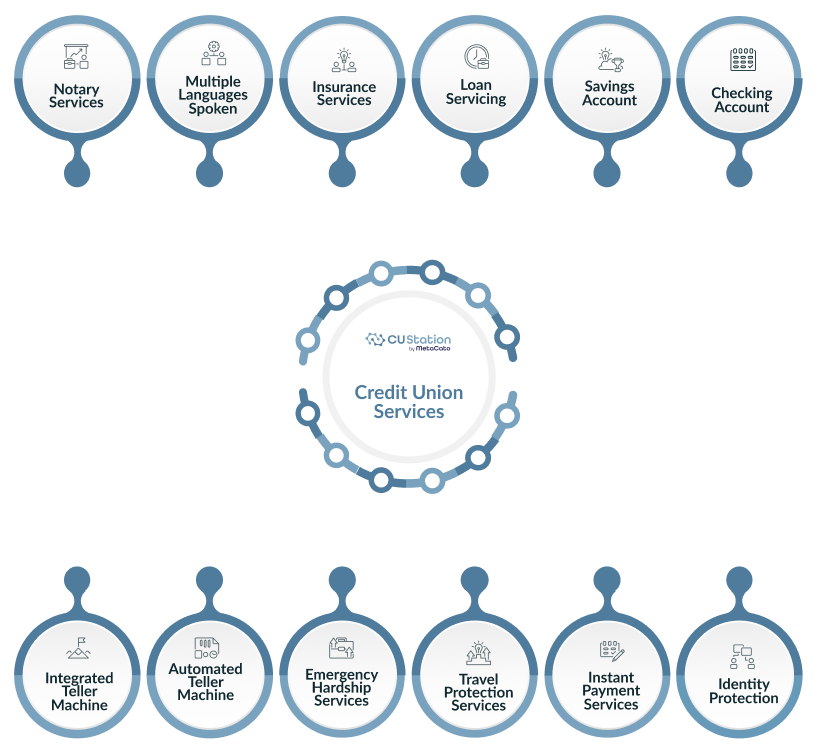

credit union services

Take your money management to the next level

A type of bank account that allows you to deposit money, withdraw funds, and write checks. It is designed for frequent transactions, such as paying bills or making purchases, and typically offers easy access to your funds through debit cards, checks, and online banking.

A bank account that allows you to save money while earning interest on the balance. It is designed for longer-term savings, often with limited access compared to a checking account, to encourage saving over spending.

The management of a loan by a financial institution or a third party after the loan has been issued. Loan servicing includes tasks such as collecting payments, sending statements, managing escrow accounts, and handling customer service related to the loan.

Services provided by financial institutions or insurance companies to offer protection against financial loss in various areas, such as health, life, auto, home, or business. Insurance services include policy issuance, premium collection, and claims processing.

Many Credit Unions offer translation services or have staff available that are able to translate for members in need.

Services provided by a certified notary public, who is authorized to witness the signing of important documents, administer oaths, and verify the identity of the individuals involved. Notary services are often required for legal documents, such as contracts, deeds, and affidavits.

Services designed to protect individuals from identity theft and fraud. These services typically include monitoring of personal information, alerts for suspicious activities, and assistance in recovering from identity theft.

Services provided by financial institutions or insurance companies to offer protection against financial loss in various areas, such as health, life, auto, home, or business. Insurance services include policy issuance, premium collection, and claims processing.

Insurance and support services that provide financial and logistical assistance in case of travel-related issues, such as trip cancellations, lost luggage, medical emergencies, and other unexpected events that may occur during travel.

Programs or services offered by financial institutions or other organizations to provide financial relief or support during times of unexpected hardship, such as natural disasters, job loss, or medical emergencies. These services may include emergency loans, grants, or other forms of financial assistance.

A machine that allows bank customers to perform financial transactions, such as withdrawing cash, depositing funds, checking account balances, and transferring money between accounts, without the need for a human teller.

A more advanced version of an ATM that provides additional banking services through video conferencing with a live teller. ITMs offer extended capabilities, such as processing complex transactions, answering questions, and providing personalized service remotely.

Credit Unions Services

Credit Union Products

Take your Financial Management to the next level

Also known as mortgages, these are loans provided by financial institutions to individuals for purchasing or refinancing a home. The property itself typically serves as collateral for the loan.

Loans provided to individuals for purchasing a new or used vehicle. The vehicle typically serves as collateral, and the loan is repaid over a specified period with interest.

A type of personal loan specifically for purchasing recreational vehicles or items, such as ATVs, jet skis, snowmobiles, or other similar "toys" for leisure activities.

Loans provided to finance the purchase of a recreational vehicle (RV). These loans often have terms similar to auto loans but may have longer repayment periods due to the higher cost of RVs.

A financial product that allows users to borrow funds up to a pre-approved limit for purchases or cash advances. Users are required to repay the borrowed amount, typically with interest if not paid in full by the due date.

Unsecured loans provided to individuals for a variety of personal needs, such as debt consolidation, medical expenses, or home improvements. These loans are not tied to collateral and are repaid with interest over a set period.

Loans designed to help students pay for post-secondary education and associated expenses, such as tuition, books, and living costs. These loans may be provided by the government or private lenders, with repayment typically beginning after graduation.

Loans provided to businesses to cover operational costs, expansion, equipment purchases, or other business needs. These loans can be secured (backed by collateral) or unsecured and are repaid with interest over time.

Home Equity Line of Credit (HELOC) loans are a type of revolving credit that allows homeowners to borrow against the equity in their home. The loan provides a credit line that can be drawn upon as needed, with the home serving as collateral.

Loans specifically designed for purchasing a new or used motorcycle. These loans often have terms similar to auto loans, with the motorcycle serving as collateral.

Short-term, high-interest loans intended to provide quick cash until the borrower’s next paycheck. These loans are typically small amounts and must be repaid in full, often leading to very high costs if not repaid on time.

Loans provided to finance the purchase of a boat, including sailboats, motorboats, or yachts. These loans are similar to auto loans, with the boat serving as collateral.

Short-term loans provided to finance the construction of a home or other real estate project. These loans are typically interest-only during the construction period and are either converted to a mortgage or paid off when the construction is completed.

Loans designed to finance environmentally friendly projects, such as energy-efficient home improvements, solar panel installations, or purchasing eco-friendly vehicles. These loans may come with favorable terms to encourage sustainable practices.

Loans specifically for purchasing a trailer, which can include utility trailers, travel trailers, or mobile homes. These loans often have terms similar to auto loans, with the trailer serving as collateral.

Financial services offered by institutions to help individuals or businesses invest in stocks, bonds, mutual funds, or other financial instruments. These services can include financial planning, portfolio management, and advice on investment strategies.

Services provided by financial institutions or insurance companies to offer protection against financial loss in various areas, such as health, life, auto, home, or business. Insurance services include policy issuance, premium collection, and claims processing.

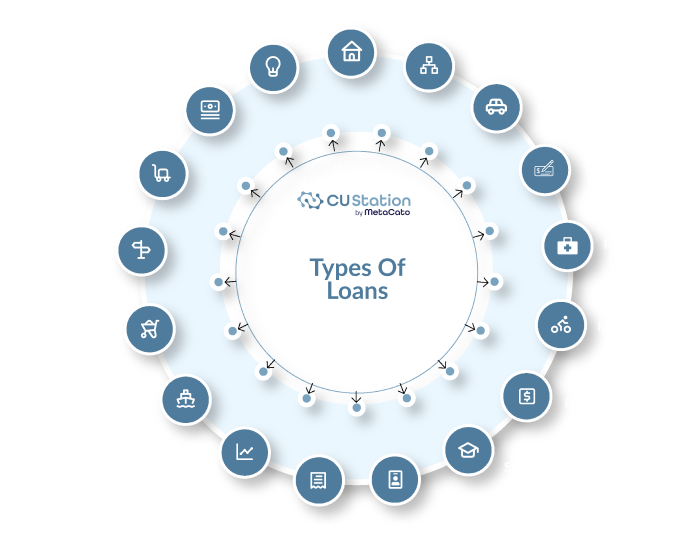

About Loans

Credit Unions provide a large variety of loan products and services to their members or shareholders.

CU Station™ brings the Credit Union industry, loans, products and services into an easy to use portal. Registered members receive quick access to match and identify the best interest rates and terms for you. Search and filtering capabilities help find the best loan for you with the ability to quickly find your favorite Credit Unions, loans with the best rates, or services to meet your needs

Community Connection

Community Connection focuses on bringing information and special deals or opportunities to our community. This includes Credit Union specials, Loans Office Specials, and more! Beyond bringing the most up to date deals, Community Connection brings the community together with additional services such as access to Community focused advisory panels, feedback panels and more to ensure responsive action is available to meet our communities’ needs.

Loan Referral Program

As part of CU Station™ we aim to assist with making it easy to identify the best loan rates and terms available for credit union loans. Registered users who complete their loan process with our partners are rewarded for their partnership with CU Station™

Partnerships

CU Station™ supports our community through partnerships focused on team members to support our Loan Assist program, Loans Offices, Real Estate Firms, and Real Estate Agents. CU Station™ partners directly with Credit Unions to ensure each Credit Union is represented accurately with their eligibility and membership requirements, their loan rates, and terms for each product they offer.