CU Station ™ Brings

The Best Loan Products

for Your Every Need

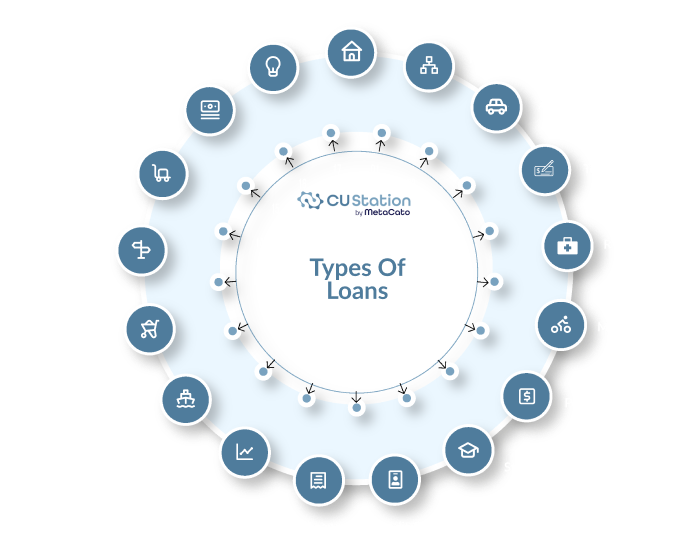

Credit Unions offer a variety of products to assist with your money management goals. These products include loans for purchasing a new home or ATV and many investment options like Certificates of Deposit (CDs) or higher yield savings accounts designed for tax free options such as children college funds.

CD Rates And Loan

Rates To You!

With CU Station™, registered users are able to quickly compare products across multiple credit unions to quickly identify the best rates and terms.

Credit Union Products

Take your Financial Management to the next level

Also known as mortgages, these are loans provided by financial institutions to individuals for purchasing or refinancing a home. The property itself typically serves as collateral for the loan.

Loans provided to individuals for purchasing a new or used vehicle. The vehicle typically serves as collateral, and the loan is repaid over a specified period with interest.

A type of personal loan specifically for purchasing recreational vehicles or items, such as ATVs, jet skis, snowmobiles, or other similar "toys" for leisure activities.

Loans provided to finance the purchase of a recreational vehicle (RV). These loans often have terms similar to auto loans but may have longer repayment periods due to the higher cost of RVs.

A financial product that allows users to borrow funds up to a pre-approved limit for purchases or cash advances. Users are required to repay the borrowed amount, typically with interest if not paid in full by the due date.

Unsecured loans provided to individuals for a variety of personal needs, such as debt consolidation, medical expenses, or home improvements. These loans are not tied to collateral and are repaid with interest over a set period.

Loans designed to help students pay for post-secondary education and associated expenses, such as tuition, books, and living costs. These loans may be provided by the government or private lenders, with repayment typically beginning after graduation.

Loans provided to businesses to cover operational costs, expansion, equipment purchases, or other business needs. These loans can be secured (backed by collateral) or unsecured and are repaid with interest over time.

Home Equity Line of Credit (HELOC) loans are a type of revolving credit that allows homeowners to borrow against the equity in their home. The loan provides a credit line that can be drawn upon as needed, with the home serving as collateral.

Loans specifically designed for purchasing a new or used motorcycle. These loans often have terms similar to auto loans, with the motorcycle serving as collateral.

Short-term, high-interest loans intended to provide quick cash until the borrower’s next paycheck. These loans are typically small amounts and must be repaid in full, often leading to very high costs if not repaid on time.

Loans provided to finance the purchase of a boat, including sailboats, motorboats, or yachts. These loans are similar to auto loans, with the boat serving as collateral.

Short-term loans provided to finance the construction of a home or other real estate project. These loans are typically interest-only during the construction period and are either converted to a mortgage or paid off when the construction is completed.

Loans designed to finance environmentally friendly projects, such as energy-efficient home improvements, solar panel installations, or purchasing eco-friendly vehicles. These loans may come with favorable terms to encourage sustainable practices.

Loans specifically for purchasing a trailer, which can include utility trailers, travel trailers, or mobile homes. These loans often have terms similar to auto loans, with the trailer serving as collateral.

Financial services offered by institutions to help individuals or businesses invest in stocks, bonds, mutual funds, or other financial instruments. These services can include financial planning, portfolio management, and advice on investment strategies.

Services provided by financial institutions or insurance companies to offer protection against financial loss in various areas, such as health, life, auto, home, or business. Insurance services include policy issuance, premium collection, and claims processing.

About Loans

Credit Unions provide a large variety of loan products and services to their members or shareholders.

CU Station™ brings the Credit Union industry, loans, products and services into an easy to use portal. Registered members receive quick access to match and identify the best interest rates and terms for you. Search and filtering capabilities help find the best loan for you with the ability to quickly find your favorite Credit Unions, loans with the best rates, or services to meet your needs