Have you ever been on the road and struggled to find a bank branch? Traditional banks often leave you high and dry, but credit unions offer a game-changing solution: shared branching. This benefit not only saves you time but also money. Here’s how it works and why it’s a big win for credit union members.

What is Shared Branching?

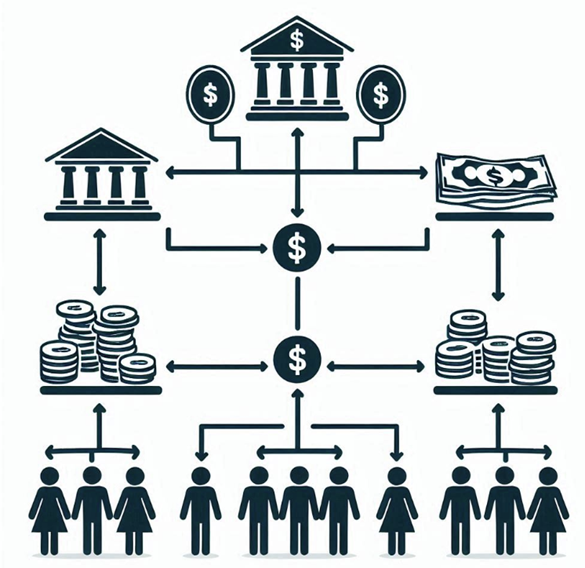

Shared branching is a nationwide network that lets credit union members perform transactions at participating branches, just like at their home branch. You can deposit, withdraw, and manage branch. You can deposit, withdraw, and manage your account without extra fees.

To use shared branching, simply provide your credit union’s name, account number, and a valid ID at any participating branch. The staff will assist with your transactions securely and efficiently

How Shared Branching Saves You Money

- Reduced Fees: Avoid hefty out-of-network fees that traditional banks charge. Shared branching means you’re less likely to need costly ATMs or branches outside your network.

- Convenience: Access thousands of branches nationwide to save time and hassle. Whether traveling or relocating, shared branching ensures easy access to your funds.

- Lower Costs: Credit unions save on operating costs by sharing branches, which translates to lower fees, better loan rates, and higher member dividends.

- Enhanced Services: Smaller credit unions can offer extensive services similar to those of large banks without additional costs, balancing convenience and personalized service.

Shared branching offers unmatched convenience and savings. Let CU Station™ find the right credit union for you to enjoy these benefits. Login link